Matt Murray's Week in Review.

By Matt Murray, former editor-in-chief of The Wall Street Journal.

We’re pleased to announce that Matt Murray, former executive editor of The Wall Street Journal, has joined News Items as a contributing editor. Matt will be doing a regular Friday feature, in the News Items format, that aggregates the most interesting and/or important stories of the week from the world of business and finance. He may also contribute “columns” about specific business or financial “news.” We’re giving him an “out” on that, in case he decides he doesn’t want to column-write. We’re hoping that he does.

By way of introduction, this interview with Matt is worth reading (and free to read). It gives you a good sense of who he is and how he approaches his work as a journalist.

For the time being, we’re calling Matt’s note “Clearing House.” It will appear in your in-boxes (and on the Substack app) at noon on Fridays. At the end of each post is a feature entitled “Matt’s Assignment Desk,” which identifies stories that deserve more coverage.

Ed. Note: If you read Matt’s posts via email (as most of you do, according to Substack’s “analytics”), you may find at the end of the email a “button” that says “view entire message.” That’s because Matt’s column may run longer than most of our posts. (This one does.)

Gmail (Substack’s email provider) truncates emails that “run long.” To read the entirety of one of Matt’s posts that “runs long”, simply click on “view entire message” and the full post will magically appear.

1. The radical restructuring that Citigroup CEO Jane Fraser promised last fall at the famously sprawling and unfocused bank is due to be mostly wrapped by the end of the first quarter. The aim was to strip out 20,000 jobs (out of about 200,000), five layers of management and exit 14 countries. So how's it going? The bank remains divided over "Project Bora Bora." Some bankers say the project is an unnecessary, McKinsey-style reshuffling marred by poor communication, others that it will strip out useless bureaucracy and simplify the complex organization. (Fraser is a McKinsey veteran.) Management ranks are seeing a shakeup, as top executives exit and others arrive. Citi scored a bit of a coup this week when it poached Viswas Raghavan, a top investment banker from JP Morgan to run its global bank, just weeks after JPM had promoted him to be sole head of its investment bank. Read Fraser's announcement note here. Culture issues are out front as well, with bankers recently cautioned to watch their drinking. Fraser clearly has her board's backing, having received a 6% pay bump last year despite profit falling almost 40%.

2. Apple is canceling its decade-long effort to build an electric car, and will shift some resources and people into generative AI. "Project Titan" was an open secret for the last decade but was never publicly confirmed by the company. The effort faced challenges from the start, with leadership and strategy changing several times. Apple failed to develop the partnerships that are essential to the complex auto industry. And it is walking away from efforts to build a self-driving electric car as the US market faces headwinds because the timeframe and costs of adoption are well beyond earlier buoyant predictions. Rumored Apple innovations, such as eliminating knobs and dials for touch screens, already have been embraced by Tesla, making it unclear quite what Apple would bring to the party. On the plus side, the iPhone has become ubiquitous in cars over the last decade. Apple shares, which had been down so far this year, rose on the report. At the annual shareholder meeting, Cook promised a lot to come on AI and teased a major announcement later this year. Still, Apple faces long-term growth questions, given its dependence on the iPhone and services, and is bracing for an expected antitrust suit from the Justice Department in coming weeks.

3. Microsoft unveiled new principles declaring its approach to developing AI, perhaps to stave off concerns about its dominant role in the sector. The principles, articulated by the company's powerful president, Brad Smith, at the Mobile World Congress in Barcelona, effectively further open access to its technology to developers, to make AI development and tools available around the world. Microsoft also said it would not use non-public information or data from the building and deployment of developers' AI models in Microsoft Azure to compete with those models, and would allow Microsoft Azure customers to easily export and transfer their data to another cloud provider. Microsoft is facing heat from European regulators over its $13 billion investment in OpenAI. The unveiling of the principles was cleverly paired with news that Microsoft was investing in a "multiyear partnership" with nine-month old French start-up Mistral AI, which is already valued at slightly more than $2 billion. Among its premises: AI companies don't need to be big (Mistral has 25 employees), nothing says the US has to dominate the field and many of its systems can be given away as open-source software. For Microsoft, the move could shift some of the focus off its close relationship with OpenAI. “We see this as a new sector of the economy that’s emerging; we call it the AI economy and it’s going to create entirely new businesses and new business categories,” Smith told the Financial Times.

4. Last week, Google was shellacked, especially by conservatives, for what many saw as absurd wokeness in its new Gemini--from images showing the Founders as black and a woman as Pope, to refusing to say whether Elon Musk or Adolf Hitler negatively impacted society more. This week, criticism has turned more from the product to the company's management--which is trying to contain the damage. Sundar Pichai, the generally low-key CEO, told employees the images generated by the tool were "biased," offensive to customers and "totally unacceptable." He vowed to rapidly retool the tool and said there was no excuse. Semafor, which broke the news, argues that more than wokeness, the debacle stems from technical errors that are fixable, but notes the reputational damage may not be. The company included a technical fix to reduce bias in the Gemini's image generation, but didn't anticipate the overcorrection and wasn't transparent. Critics say the problem is rooted in Google's culture and that a transformation is needed. These are not "hallucinations" but deliberately calibrated choices. The product is only the latest to be rushed by Pichai, who has a history of carelessness as he pushes for growth. Is Google now the new IBM? Adding to Google's mounting headaches, 32 media companies, led by Axel Springer and Schibsted, filed a $2.3 billion lawsuit against the company in Brussels Wednesday, alleging they have suffered losses due to its digital practices.

5. Elon Musk sued Sam Altman and OpenAI, saying they have reneged on their original mission of serving all humanity to "become a closed-source defcato subsidiary" of Microsoft. The suit from Musk, who helped found OpenAI in 2015, marks a dramatic escalation of a long-simmering feud. Musk has often warned that poorly built AI could have catastrophic consequences. He argued in his suit, filed in San Francisco, that last fall's leadership shakeup, in which Altman was fired and then restored, led the CEO and Microsoft to team up and replace most of the board, negating its original, more altruistic, mission and design. Meanwhile, the SEC is reportedly scrutinizing Altman's emails to see if investors were misled in that episode. A law firm review of Altman's firing and rehiring is nearing conclusion. On another front in AI this week, shares of Snowflake plunged after CEO Frank Slootman, who took the cloud software company public in 2020, surprised investors by announcing his retirement. The news came with a disappointing earnings outlook, but Slootman said that was unrelated to his decision. The company named Sridhar Ramaswamy, former Google ad chief, as its new CEO, saying he was better suited for the coming AI wave. Stepping aside as he did was a generous decision for an established CEO in the face of a new tech wave.

6. Is winter over? Bitcoin topped $60,000 this week for the first time since November 2021, amid optimism that the currency is finally reaching beyond hard-core digital enthusiasts. New spot ETFs from mainstream firms are bringing more investors into the space and helping drive the surge. The SEC was compelled to approve them last month, after years of resistance, following a court ruling; that has allowed mainstream firms like BlackRock and Fidelity to offer products; Blackrock’s spot Bitcoin ETF especially has boomed. Morgan Stanley might join the party. An upcoming reduction in supply also looms, stoking FOMO. The all-time high for Bitcoin is $69,045, set on Nov. 10, 2021. Ether funds could be next, especially given the limited supply of Bitcoin, but the SEC remains uneasy about crypto. Trading remained volatile, and concerns are rising as leverage seeps back into all corners of the market.

7. Universal Music Group, which has been fierce in defending the rights of its artists, invoked the "nuclear option" with TikTok in their ongoing negotiation. by insisting that any video with music from one of its stars be taken down. The showdown pits the powerful Chinese-owned social-media giant against the label behind Taylor Swift, Drake and Billie Eilish, among many others. After years of offering TikTok discounted terms, Universal wants TikTok to start paying royalties in a longer-term deal, as apps like Instagram and YouTube do. For TikTok, music just no longer matters the way it once did. The escalating fight could do much to reshape the fraught relationship between social media companies and musicians, given Universal's scale. Separately, TikTok shook up its executive ranks, including oversight of trust and safety.

8. The FTC's latest effort to block a merger--in this case, Kroger's $25 billion bid for Albertson's--could take months to play out and even run into 2025. The FTC claimed the deal would lead to higher prices--at a time when food inflation is a concern--and hurt union bargaining power, an unusual overt union citation in such an action. The case is a test of new, more expansive guidelines developed under Chair Lina Khan that can be used to block mergers. Conservatives see a gift to superstores, a union giveaway and yet another case (to them) where the agency's definition of what constitutes a market is out of touch. The FTC's market definition for groceries dates from the mid-1990s. Progressives see the FTC move as a strike against higher prices hurting consumers and in that sense an assist to the White House on inflation. Unions applauded. Matt Stoller thinks it's dead. If that's the case, Walmart would be a likely beneficiary. Khan also took a victory lap this week on blocking the merger of Nvidia and Arm in 2022--and won praise from JD Vance. For a different view on the right, Commentary goes deep on Khan's tenure. On another deal front, an Exxon challenge could tank Chevron's $53 billion deal for Hess.

9. Macy's new CEO said the chain is closing some 30% of its stores in the next three years, but will open more Bloomingdale's and Bluemercury outlets, which skew toward luxury. It is the latest restructuring effort by the chain, which is grappling with the ongoing shrinking of brick-and-mortar retail--sales are forecast to drop up to 4% this year--and a push by activist investors. Among the closures will be its iconic San Francisco store, underscoring that downtown shopping might have had its day.

10. David Zaslav and Warner Bros. Discovery Warner Brothers halted discussions with Paramount Global, with their stock near a 52-week low. The news came after last week's earnings miss. Though management has cut debt, it keeps missing its EBITDA guidance. Is it time to panic? Also in Zaz-land, last weekend's WSJ story on his efforts to "uncancel" JK Rowling is worth reading. And Paramount missed revenue targets but surprised on the upside with its earnings after its cost cuts.

11. Disney announced a significant $8.5 billion deal with Reliance Industries, India's largest conglomerate, creating a media powerhouse in the subcontinent. In the latest reshaping of its portfolio, Disney will merge its Star India operations, which it gained in its 2019 acquisition of 21th Century Fox, with Viacom18, a Reliance unit. The combination could remake the Indian entertainment and media landscape, with a 40% market share and 85% of the streaming audience. Disney had been hemorrhaging money and customers in the world's most populous nation, especially after losing valuable cricket rights to Reliance in 2022, damaging in cricket-obsessed India. It will have a stake of about 37% in the combined venture. Asia's richest man, Mukesh Ambani, will control the venture, and his wife, Nita Ambani, will be chairperson. Reliance will invest $1.4 billion in the new entity. The deal, while seen as good for Disney, marks a significantly lower valuation for the former Fox assets in India since they were acquired. In a big boost for Bob Iger, his ongoing renovation won the backing of Disney heirs, including Abigail Disney, as he works to fend off activist Nelson Peltz.

12. Elsewhere in Asia, Mark Zuckerberg was on a whirlwind tour. In Japan, he talked about AI with the prime minister, met with a sword master and stopped by McDonald's. In South Korea, he sat down with the heads of LG Electronics and Samsung to discuss collaborations and met the president. He and Bill Gates (and Rihanna) are expected this weekend at the lavish wedding of the Ambanis' son. It all reflects his ecletic interests and is helping him reinvent his image, from robotic to authentic.

13. Kara Swisher's new memoir on her time covering Silicon Valley drew some underwhelming reviews. Critics say "Burn Book" is hardly scorching, breezy but lively and that she was arguably late to start going after Big Tech. Is she tearing tech billionaires down--or burnishing their legends? On her media tour this week, Swisher dishes here on how Silicon Valley leaders, in her view, became cartoons; and here says she still harbors hopes for the industry. (Note: Swisher is a former colleague and friend. I haven't read the book yet but will report back when I do.)

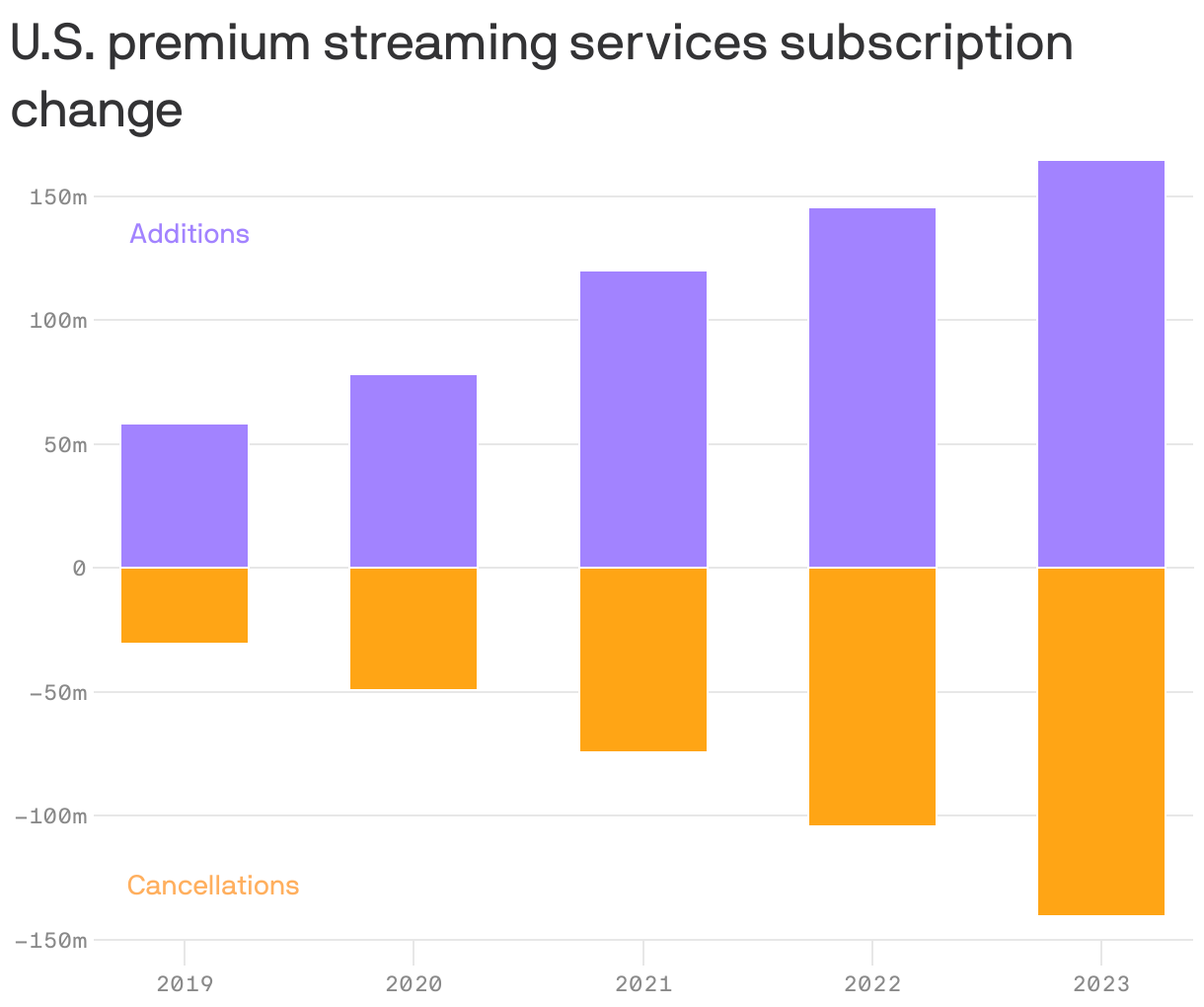

Chart(s) of the week:

Axios starkly laid out the challenge facing just about every content provider, showing the steady decline of cable and the rising churn in streaming. Notes Axios: "There are only two winners right now--Netflix and live sports."

Footnotes: David Solomon and Jamie Dimon warn not to count on a soft landing...New York Community Bancorp warned of "material weakness" in how it tracks loans, reported a big loss and replaced its CEO...Meet the new head of film at Netflix, one of Hollywood's most coveted jobs...Dell shares soared more than 20% ona forecast that beat expectations thanks to demand for AI-related gear...Wendy's races to contain the damage after CEO's talk of Uber-style "surge pricing" (bad news for fans of the Baconator, Dave's Double and Chicken Nuggets?)...European regulators are probing Microsoft on security software...Weight Watchers shares plummet after Oprah Winfrey quits the board and donates her shares (she's taking Ozempic) ...Sam Bankman-Fried suggests he should serve five to six years, not 100, citing his autism and saying he was motivated by altruism, not greed...Deal allowing employees to cash out values Stripe at $65 billion...Domino's rising sales buck fast-food trends...Why family-owned bagel and lox institution Russ & Daughters doesn't have a mission statement...Bezos, Zuckerberg, Dimon, the Waltons and others are selling a lot of shares...Bumble is laying off 37% of its staff, and Electronic Arts 5%....Forget food inflation, and maybe everything else. Applebee's is selling $1 margaritas.

Columns: Rushfeld: Disney's move to replace Sean Bailey as its motion picture chief shows how it and Netflix have opposite aims right now...Salmon: OpenAi's talk of raising $5 trillion to $7 trillion is "preposterous" but strategic...Ip: Japan is back. Is inflation the reason?...Tett: Green reporting rules are coming for companies...Bartleby: Why you should lose your temper at work.

Assignment Desk: We’re going to hear a lot this campaign about Biden’s big spending/investment bills. Can someone “effort” some deep, non-political (ha) looks at what has actually happened so far, by following the money? The $1 trillion infrastructure bill was signed more than two years ago, in November 2021; presumably, all kinds of projects are now underway to “fix” our bridges and roadways and power grid, and many investors and companies are getting money. Is that happening? Ditto the CHIPS act, which passed a year and a half ago now, and the misnamed Inflation Reduction Act, which included a slug of money for investment in “green initiatives.” How is all this spending, all these initiatives, playing out? The WSJ this week took a solid look at how southern states are benefiting from green factories, but there is room for plenty more shoe-leather reporting on the consequences, for good or ill.

This is very good. A solid addition to an already-valuable offering.

It is very cool to see Matt Murray here in the John Ellis News Items.