Private Credit.

The view from Westport.

Bridgewater Associates is the world’s largest hedge fund. Every weekday, it sends out a note to its clients entitled ‘Bridgewater Daily Observations’. Every so often, the firm allows us to republish, in part or in full, an individual edition of its ‘Daily Observations’.

The October 23rd edition of ‘Bridgewater Daily Observations’ addressed this question: How concerned should we be about recent developments in “credit markets”? Bridgewater’s short answer was/is: “Despite high-profile bankruptcies, when we assess credit markets overall, we don’t see signs of broad issues.”

The longer answer is excerpted (in part) below.

Bridgewater Daily Observations.

by Yusuf Jailani and Greg Weaving. (23 October 2025)

The recent bankruptcies of First Brands Group and Tricolor, along with concerns about risks in the regional bank sector, have raised the question of whether we are beginning a material credit downturn. While things can change, we do not currently see the dynamics that usually cause major credit problems.

The credit cycle is a fundamental component of the economic machine, operating with predictable cause-and-effect relationships that we embed in our investment process. While every cycle presents unique features—new lending products, different innovations—we believe the broad dynamics of credit expansion and contraction across cycles are far more alike than they are different. Historically, the most damaging credit cycles—those with a large and lasting impact on the economy—have featured some combination of three critical elements in their expansions:

Large credit creation, especially to less creditworthy borrowers or for speculative purposes.

A leveraged lender base that magnifies losses by being forced to withdraw capital when it is needed most.

Complacent market pricing that fails to differentiate between higher- and lower-credit-risk borrowers.

These features are, in turn, what fuel larger and more damaging loss cycles when the credit cycle turns. While conditions aren’t uniform across the market and can change rapidly, we think the credit cycle that has taken place has, so far, generally been resilient across these dimensions:

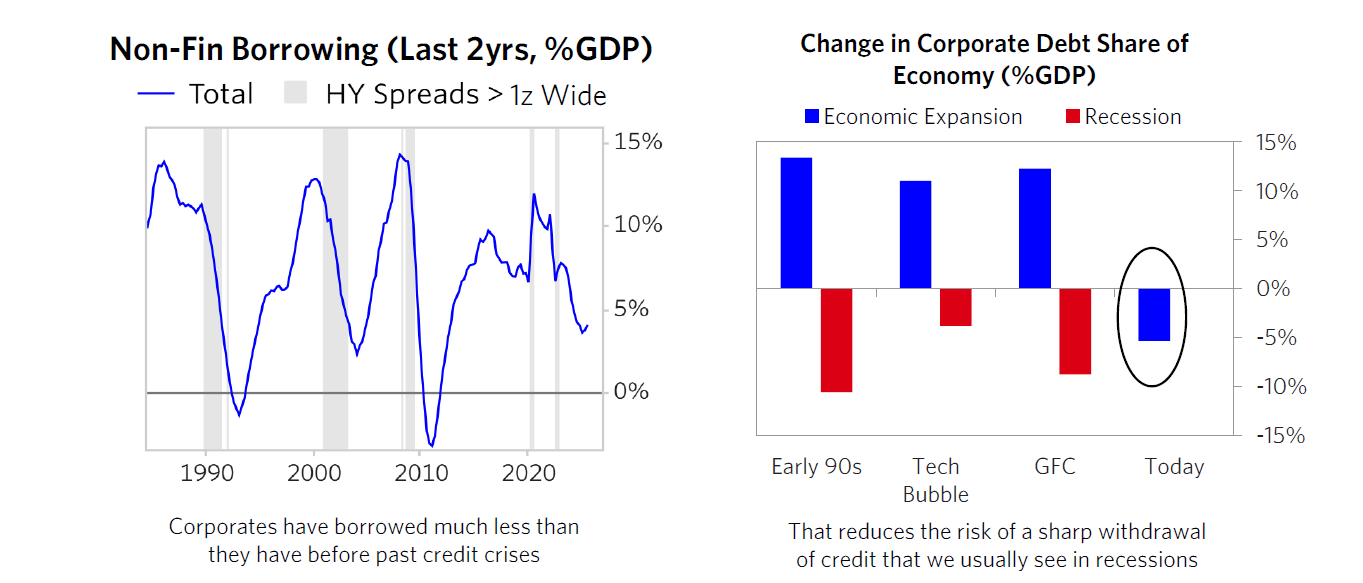

We’ve had little aggregate private sector borrowing, with relatively low levels of speculative issuance. Post-COVID growth was largely fueled by government spending and a cash-supported capital expenditure boom, not debt. This has kept balance sheets healthy and significantly reduced the risk of a sharp credit unwind causing a subsequent decline in incomes. Little credit has been directed toward aggressive uses like debt-fueled M&A or dividend recapitalizations, and while isolated exceptions exist, borrowing excesses appear limited.

Lenders are largely not overextended, and the rise of private credit (PC) has helped to diversify and de-lever the financial system. Across financing channels, lenders look well-positioned to extend new credit and cushion unforeseen shocks. In addition, the evolution of the credit system, driven in part by the rise of private credit, has made the overall ecosystem more stable. Following the financial crisis, banks de-leveraged and retreated from the riskiest lending segments. Less leveraged private credit lenders filled the gap, increasing the diversity of the lending pool and reducing the potential for contagion.

Market pricing reflects robust differentiation between higher- and lower-risk borrowers. In excessive credit cycles, the dispersion in spreads between strong and weak credit tends to collapse as investors aggressively chase yield, compromising lending standards. Today, while spreads in aggregate are low, underneath the hood, dispersion between borrower spreads is relatively elevated, which reflects healthy market dynamics and a reluctance by investors to compromise quality for yield.

This doesn’t mean that pockets of stress will not emerge, especially with some slowing in economic activity. The recent First Brands Group bankruptcy, for instance, stemmed from an aggressive debt-fueled strategy that later revealed potential issues around collateral financing. However, this kind of excessive activity has been rare. We believe these instances, while causing losses for some investors, are idiosyncratic, not systemic, and do not signal the start of a broader and more damaging credit contraction.

Going forward, we expect credit to play a larger role in the business cycle as borrowing picks up. The AI-spending boom is likely to enter a more credit-intensive phase as the buildout accelerates. At the same time, material progress on deregulation could unleash a wave of corporate activity. These forces have the potential to drive corporate credit creation up significantly.

As shown below, so far in this expansion, corporates have borrowed much less than they have in prior cycles. That reduces the risk and economic impact of a sharp reversal.

Important Disclaimers:

This research is prepared by and is the property of Bridgewater Associates, LP and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, Bridgewater’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. Any such offering will be made pursuant to a definitive offering memorandum. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular investment. The companies discussed should not be taken to represent holdings in any Bridgewater strategy. It should not be assumed that any of the companies discussed were or will be profitable, or that recommendations made in the future will be profitable.

The information provided herein is not intended to provide a sufficient basis on which to make an investment decision and investment decisions should not be based on illustrative information that has inherent limitations. Bridgewater makes no representation that any account will or is likely to achieve returns similar to those shown. The price and value of the investments referred to in this research and the income therefrom may fluctuate. Every investment involves risk and in volatile or uncertain market conditions, significant variations in the value or return on that investment may occur. Investments in hedge funds are complex, speculative and carry a high degree of risk, including the risk of a complete loss of an investor’s entire investment. Past performance is not a guide to future performance, future returns are not guaranteed, and a complete loss of original capital may occur. Certain transactions, including those involving leverage, futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors. Fluctuations in exchange rates could have material adverse effects on the value or price of, or income derived from, certain investments.

Bridgewater research utilizes data and information from public, private, and internal sources, including data from actual Bridgewater trades. Sources include BCA, Bloomberg Finance L.P., Bond Radar, Candeal, CEIC Data Company Ltd., Ceras Analytics, China Bull Research, Clarus Financial Technology, CLS Processing Solutions, Conference Board of Canada, Consensus Economics Inc., DTCC Data Repository, Ecoanalitica, Empirical Research Partners, Energy Aspects Corp, Entis (Axioma Qontigo Simcorp), Enverus, EPFR Global, Eurasia Group, Evercore ISI, FactSet Research Systems, Fastmarkets Global Limited, The Financial Times Limited, Finaeon, Inc., FINRA, GaveKal Research Ltd., GlobalSource Partners, Harvard Business Review, Haver Analytics, Inc., Institutional Shareholder Services (ISS), The Investment Funds Institute of Canada, ICE Derived Data (UK), Investment Company Institute, International Institute of Finance, JP Morgan, JTSA Advisors, LSEG Data and Analytics, MarketAxess, Metals Focus Ltd, MSCI, Inc., National Bureau of Economic Research, Neudata, Organisation for Economic Cooperation and Development, Pensions & Investments Research Center, Pitchbook, Political Alpha, Renaissance Capital Research, Rhodium Group, RP Data, Rubinson Research, Rystad Energy, S&P Global Market Intelligence, Sentix GmbH, SGH Macro, Shanghai Metals Market, Smart Insider Ltd., Sustainalytics, Swaps Monitor, Tradeweb, United Nations, US Department of Commerce, Visible Alpha, Wells Bay, Wind Financial Information LLC, With Intelligence, Wood Mackenzie Limited, World Bureau of Metal Statistics, World Economic Forum, and YieldBook. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Bridgewater to any registration or licensing requirements within such jurisdiction. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Bridgewater ® Associates, LP. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy. Data leveraged from third-party providers, related to financial and non-financial characteristics, may not be accurate or complete. The data and factors that Bridgewater considers within its investment process may change over time.

This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability, or use would be contrary to applicable law or regulation, or which would subject Bridgewater to any registration or licensing requirements within such jurisdiction. No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Bridgewater® Associates, LP.

The views expressed herein are solely those of Bridgewater as of the date of this report and are subject to change without notice. Bridgewater may have a significant financial interest in one or more of the positions and/or securities or derivatives discussed. Those responsible for preparing this report receive compensation based upon various factors, including, among other things, the quality of their work and firm revenues.

Wait. Private lenders, who are funded by borrowing from banks, are LESS leveraged than banks, who are funded by deposits? If such a private lender gets into trouble and puts those bank loans at risk, there’s LESS risk of contagion? Credit quality spreads are [in fact, very] tight in the aggregate but “ under the hood” everything is OK? What does that even mean?