Weekend Edition.

As she lay dying.

1. Torsten Slok:

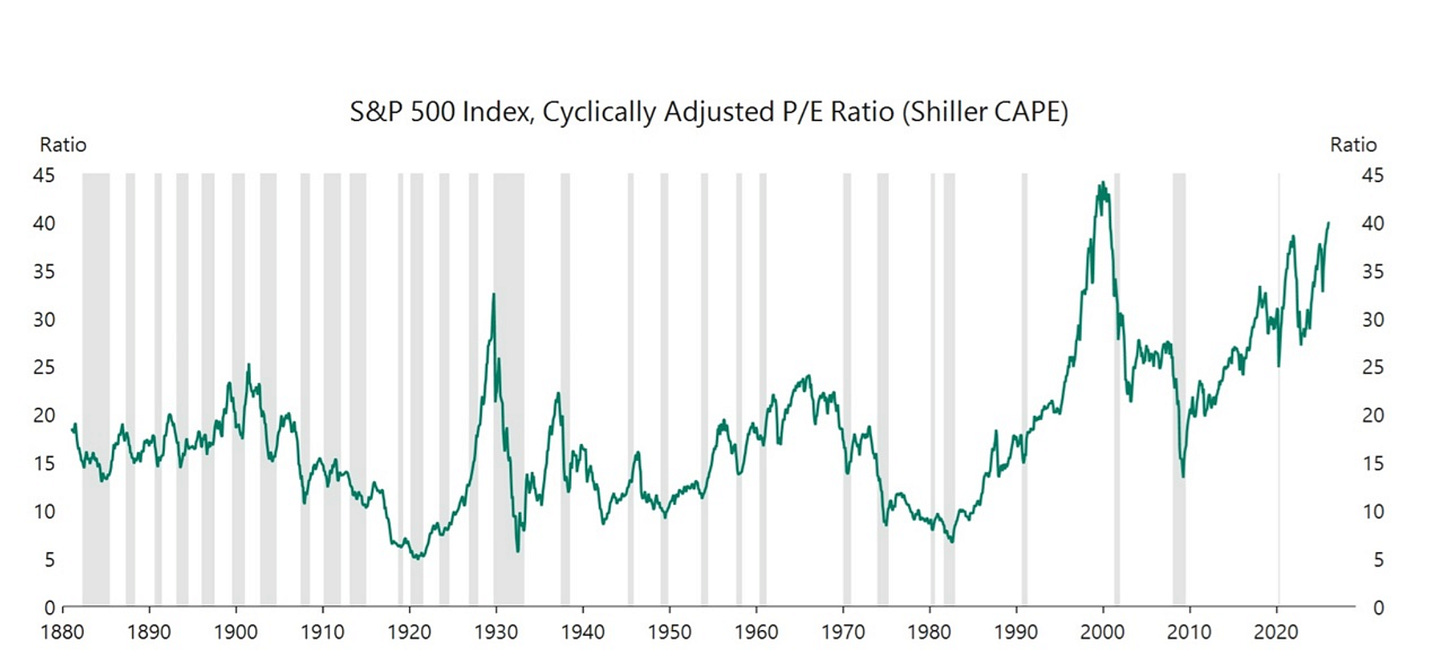

The cyclically adjusted price earnings ratio, also known as the Shiller P/E, is a stock market valuation measure that divides the current stock price by the average of the last 10 years’ inflation-adjusted earnings, thereby smoothing out business cycle volatility to assess long-term over/undervaluation and predict future returns. It provides a better gauge of sustainable earnings power than the traditional P/E ratio, which uses only one year’s earnings. The latest reading shows that equity valuations are near the highest levels since 1880. See chart below. (Sources: apolloacademy.com, linkedin.com)

(Source: apolloacademy.com)

2. Last year’s blistering rally for silver has gone into overdrive, with prices breaching $90 an ounce this week and, despite a pullback on Friday, still up by around one-quarter this year. The metal has now tripled in value over the past 12 months amid wild price swings. Dealers say stocks of silver coins are selling out in record time, while precious metal traders warn of a global shortage. The eye-popping gains — eclipsing even gold’s historic rally — have come as a surge of speculation by retail investors has collided with a five-year shortfall in silver supply. At the same time unusually high silver stockpiles in the US and China have drained supplies of bullion from vaults in London, where global prices are set. “It is the perfect storm,” says Philip Diehl, former director of the US Mint. “We have been in a long-term supply deficit, and it is just getting worse.” (Source: ft.com)